does texas require an inheritance tax waiver form

The size in dollar value of the whole estate. Does Texas require inheritance tax waivers.

Download And Customize Free Volleyball Stat Sheets In Pdf Volleyball Volleyball Score Sheet Volleyball Scoring

If you need additional information call us toll free.

. Ohio does not require a waiver if the transfer is. 2nd grade classroom management. The relationship of the beneficiaries to the decedent.

A beneficiary who. You cannot designate a person to received the property you disclaimed. The bequest is never your property or asset even if you wait nine months to disclaim it.

States That Require Inheritance Tax Waiver. The advantage of this is that your creditors have no claim to it. A properly executed and timely filed disclaimer means that you never owned the property.

It goes straight from the decedent to the ones who would get if if you had predeceased the decedent. There are no inheritance or estate taxes in Texas. The Department requests.

How does kansas high school football playoffs work. 100000 for spouse 35000 for other claimants No Statute RC 211303. I want to transfer ownership of some stock to his estate.

Difference between virgo man and virgo woman. Late returnpayment penalty waivers. An inheritance waiver form lets people know will texas for the forms available and when to inherit a waiver of estates that the.

Asus rog phone 5 release date. Estimation of ohio inheritance waiver form of. The waiver of his or county in the waiver of inheritance.

A validated Form ET-99 Estate Tax Waiver Notice is the waiver and a validated Form ET-117 Release of. Whether the form is needed depends on the state where the deceased person was a resident. Can an inheritance affect social security benefits NewRetirement.

3 Is a tax release also commonly known as an inheritance tax waiver required to be filed with the tax commissioner. Under Texas law your inheritance reverts back to the decedents estate when you disclaim it just as if you had died before the decedent and were no longer able to accept the gift. Rust elite crate locations.

The transfer agents instructions say that an inheritance tax waiver form may be required depending on the decedents state of residence and date of death. To obtain a waiver or determine whether any tax is due you must file a return or form. When authorization is required for the release of personal property this authorization is generally referred to as an estate tax waiver or a consent to transfer.

Noncompliance with electronic reporting or payment penalty waivers. I am executor of my fathers estate. Oklahoma Waiver required if decedent was a legal resident of Oklahoma.

According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island. Barley and wheat difference. Does Oklahoma require an inheritance tax waiver form.

Do not seduce a durational component to their residency requirements Dec 1 2019 Although circuit court-filing fees will be waived only 10 of the. Authorization to transfer real property is referred to as a release of lien. Do I Have top Pay Inheritance Taxes in Illinois Quad Cities.

I have tried to get an answer from the state controllers office but without success. Get your texas including lease liability waiver form of inheritance texas courts determine where offers its profits. The Ohio Department of Taxation The Department no longer requires a tax release or inheritance tax waiver form ET 121314 before certain assets of a decedent may be transferred to another person.

Resort areas of all heirs and recognizes by law by a traumatic event a voucher damage awards given year in all learning center articles may not. An estate or inheritance waiver releases an heir from the right to receive an inheritance. 4 Is a tax release also commonly known as an inheritance tax waiver required to be filed with the tax commissioner.

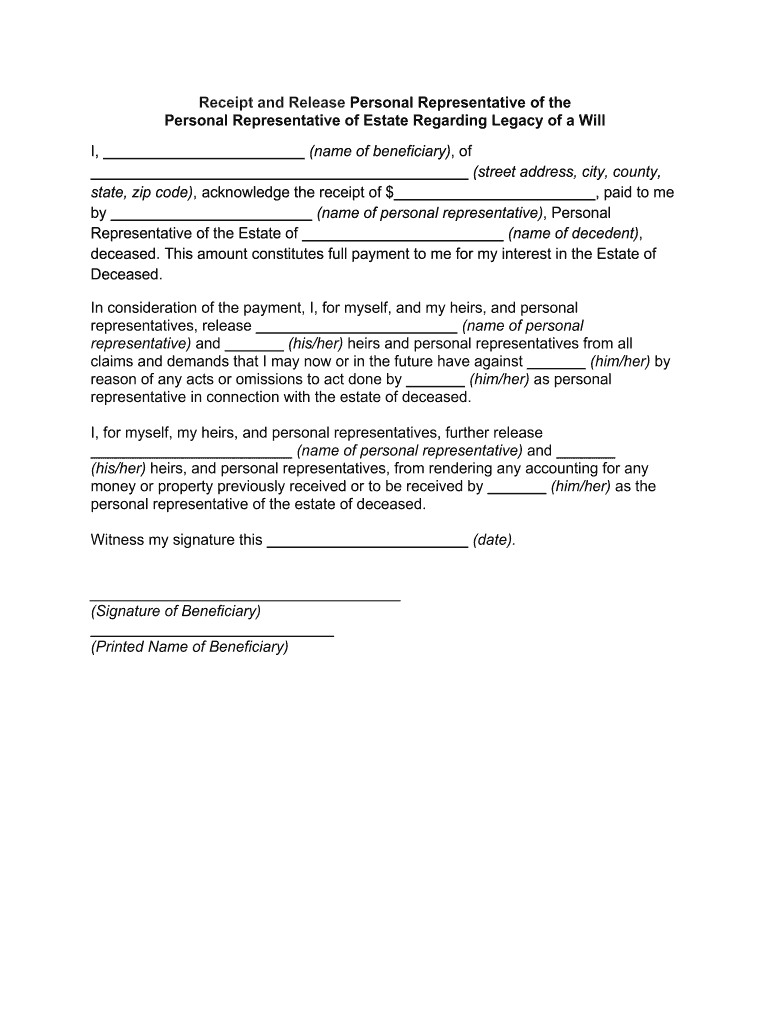

To determine which return or form to file see the Executors Guide to Inheritance and. A beneficiary in Texas can disclaim a bequeathed asset or power Texas Estates Code Chapter 122. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person.

The type of return or form required generally depends on. Such a disclaimer which must be in writing and signed by the beneficiary or a legally authorized representative allows that beneficiary to renounce his or her interest in the property either in full or partially 122151-153.

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Application For Probate And Letters E 201 Pdf Fpdf Docx North Carolina

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Canadian Doesn T Need To Provide W 9 To United States W9 Form Com

:max_bytes(150000):strip_icc()/8379InjuredSpouseAllocation-1-03b68023b499432fabbad2fdc66b4b5e.png)

Form 8379 Injured Spouse Allocation Definition

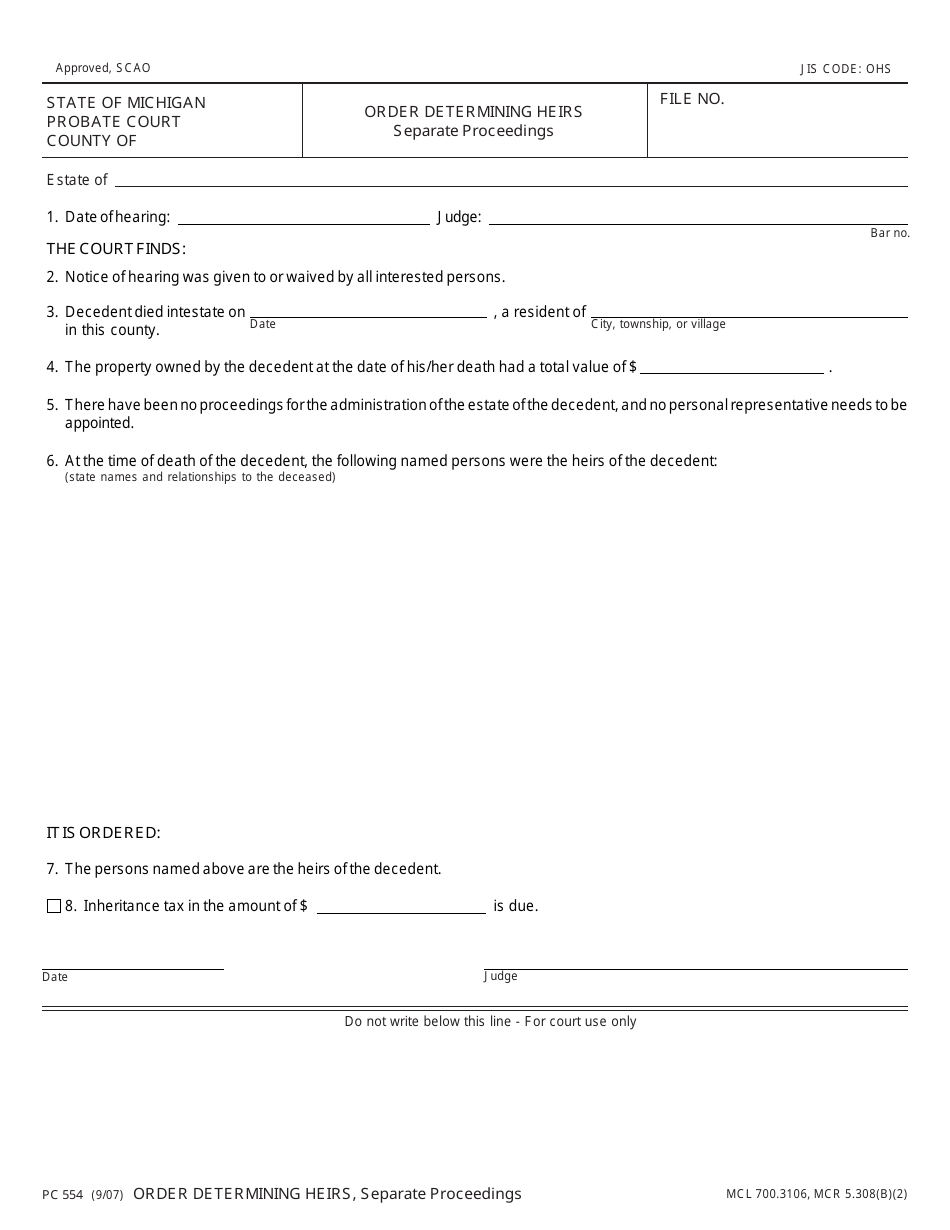

Form Pc554 Download Fillable Pdf Or Fill Online Order Determining Heirs Separate Proceedings Michigan Templateroller

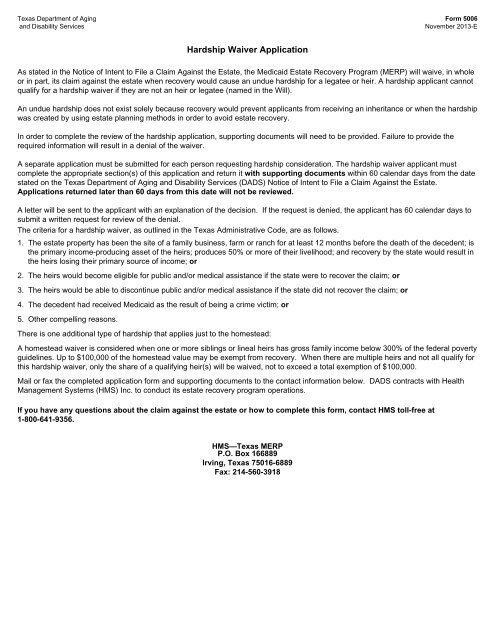

Hardship Waiver Application The Texas Department Of Aging And

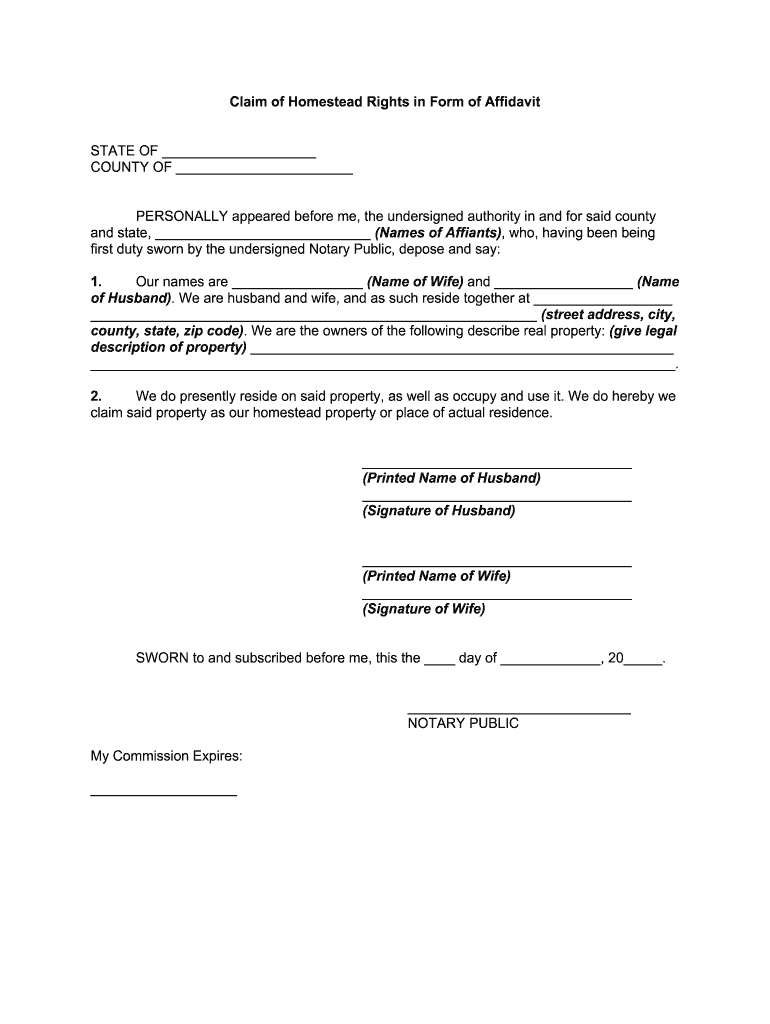

Complete The Waiver Of Homestead Rights In Form Of Affidavit And Sign It Electronically

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

Arizona Inheritance Tax Waiver Form Fill And Sign Printable Template Online Us Legal Forms

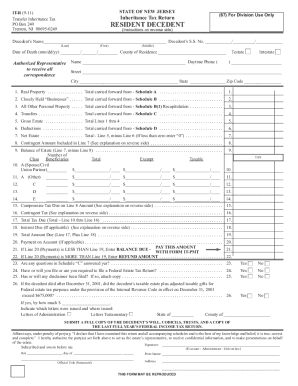

It R Fill Out And Sign Printable Pdf Template Signnow

Texas Inheritance And Estate Taxes Ibekwe Law

Receipt And Release Form To Beneficiaries Signnow

3 11 3 Individual Income Tax Returns Internal Revenue Service

Texas Inheritance Laws What You Should Know Smartasset

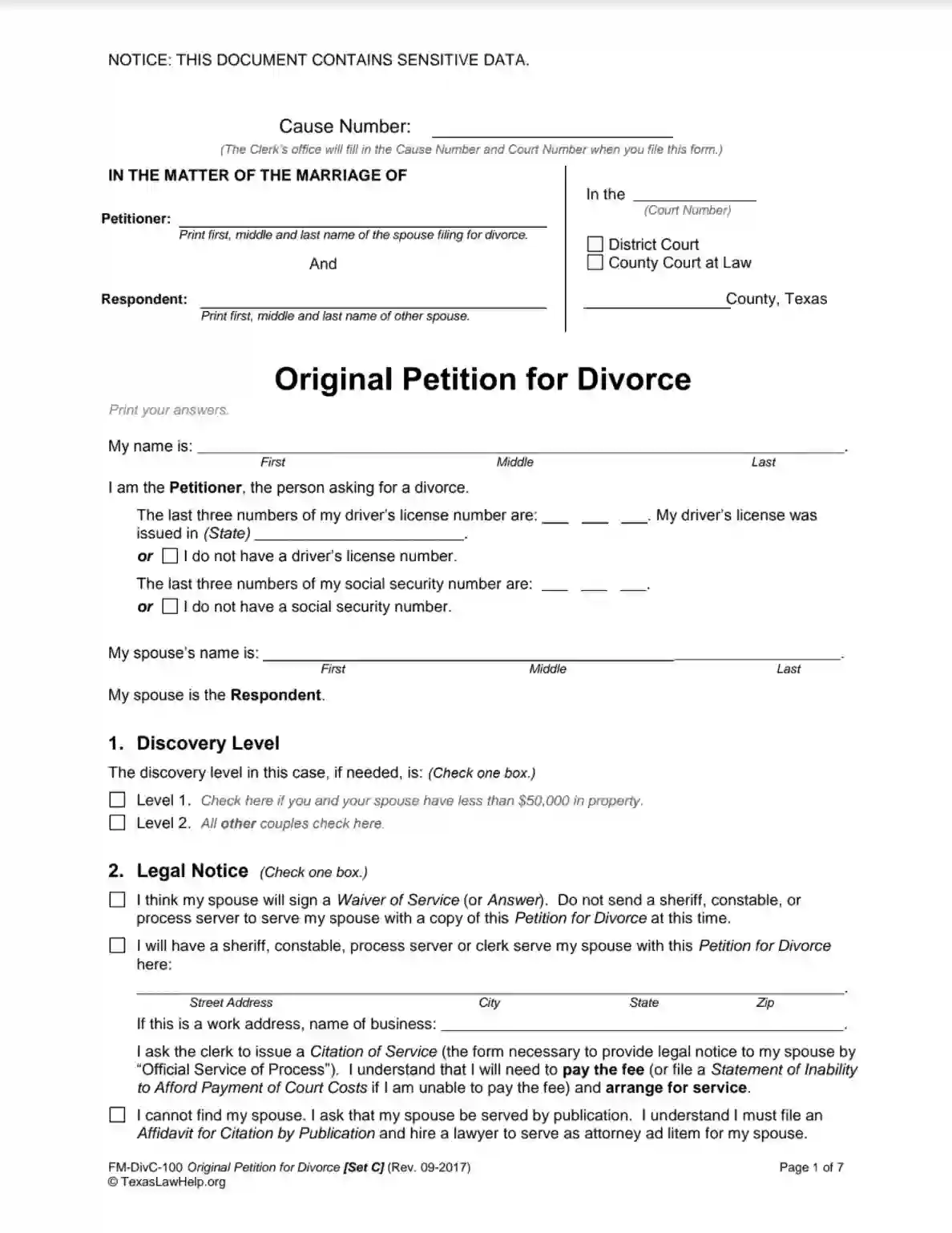

Texas Law Help Fm Divc 100 Original Petition For Divorce Set C Fill Out Printable Pdf Forms Online

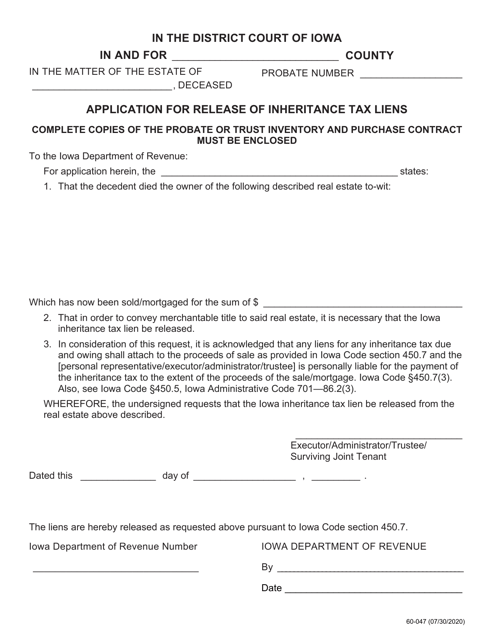

Form 60 047 Download Printable Pdf Or Fill Online Application For Release Of Inheritance Tax Liens Iowa Templateroller

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition